Details for Oct 7 PH Abatement Parcels

CITY OF BLAINE ANOKA AND RAMSEY COUNTIES STATE OF MINNESOTA NOTICE OF PUBLIC HEARING NOTICE IS HEREBY GIVEN that the City Council of the City of Blaine, Minnesota (the City), will hold a public hearing on October 7, 2024 beginning at approximately 7:00 P.M. or as soon thereafter as the matter may be heard, at the City Hall, 10801 Town Square Drive NE in the City on the proposal to abate certain property taxes levied by the City on the property listed below (the Abatement Parcels); provided, however, that the City may determine at any time to remove certain property from the Abatement Parcels pledged to the payment of the Bonds defined below if it determines that the abatement collected from the remaining Abatement Parcels is sufficient to pay the principal amount of the Bonds. ABATEMENT PARCELS The purpose of the proposed abatement is (i) to assist in financing the acquisition, construction and betterment of an event stadium complex in the City; and (ii) to finance certain public improvements including without limitation acquisition of real property and construction and betterment of certain public infrastructure, which includes but is not limited to public rights-of-way/streets, public utilities, and public open space areas in connection with the development of such event stadium complex (collectively, the Project), through the issuance of general obligation tax abatement bonds under Minnesota Statutes, Sections 469.1812 through 469.1815, both inclusive (the Bonds). In addition, the EDA proposes entering into an agreement with Blaine Town Center West LLC, a Minnesota limited liability company (or an affiliated entity to be formed, the Developer) under which the EDA will provide a portion of the proceeds of the Bonds to the Developer, and the Developer will agree to construct the Project. The assistance will be a business subsidy under Minnesota Statues, Sections 116J.993 to 116J.995 (the Business Subsidy Law). After the public hearing, if the creation or retention of jobs is determined not to be a goal, the wage and job goals may be set at zero in accordance with the Business Subsidy Law. A summary of the proposed terms of the business subsidy is on file and available for public inspection at the office of the Citys Community Development Director in City Hall during regular business hours. Any person with a residence in the City or who is the owner of taxable property in the City may file a written complaint with the City if the City fails to comply with the Business Subsidy Law. No action may be filed against the City for the failure to comply unless a written complaint is filed. At the public hearing, the City Council will consider an abatement resolution under which the City will pledge all or a portion of the Citys share of property taxes from the Abatement Parcels to the payment of the Bonds. The total amount of abatement is estimated not to exceed $48,500,000, representing the aggregate abatement dollars to be collected by the City over a maximum of 20 years. The proposed abatement bonds will not affect tax rates for the Abatement Parcels or otherwise impact the Abatement Parcels differently from other parcels in the City. The City Council will give all persons who appear at, or submit comments in writing prior to, the hearing an opportunity to express their views with respect to the proposal. BY ORDER OF THE CITY COUNCIL OF THE CITY OF BLAINE, MINNESOTA Published in The Life September 20, 2024 1421953

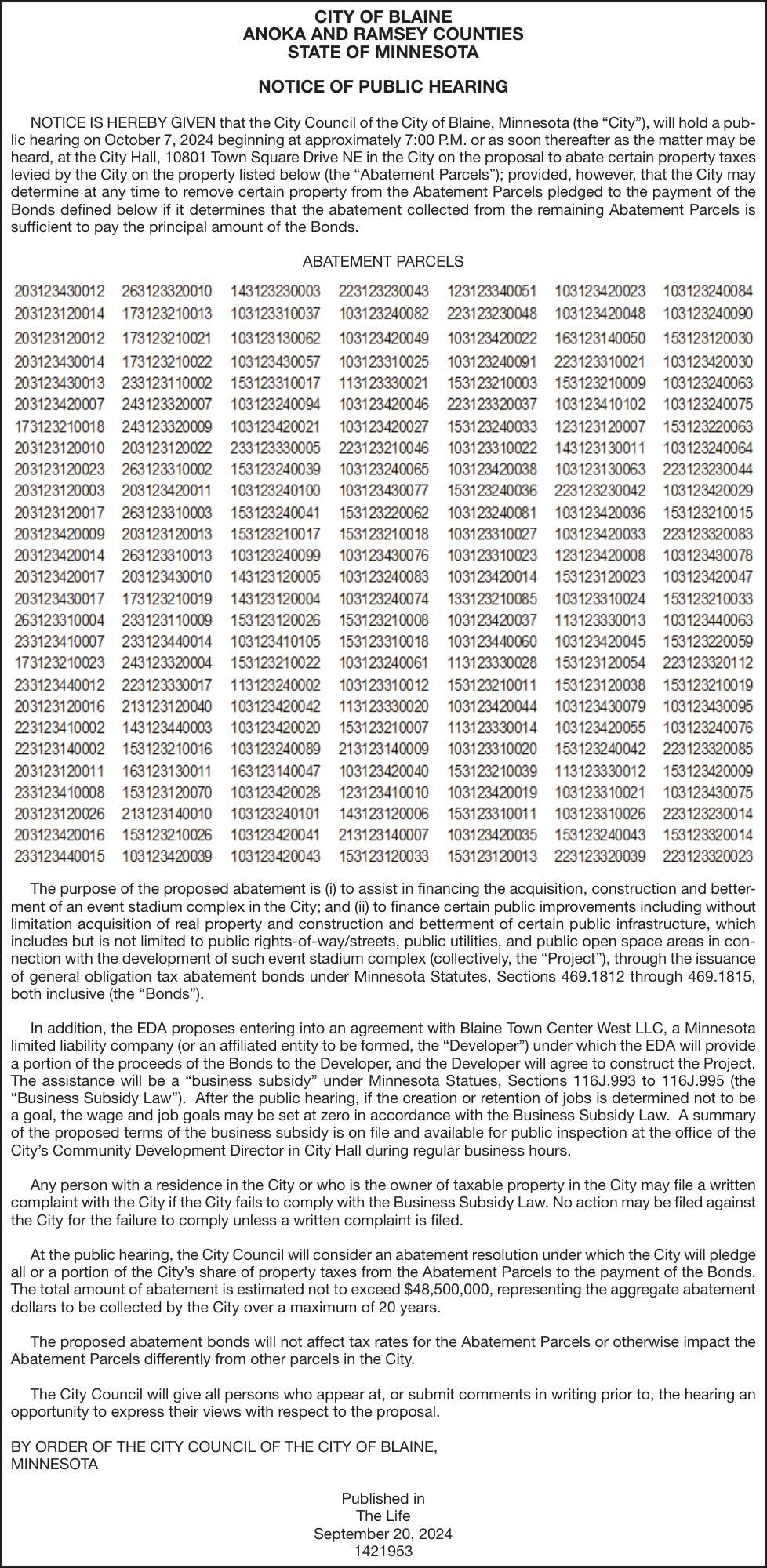

CITY OF BLAINE ANOKA AND RAMSEY COUNTIES STATE OF MINNESOTA NOTICE OF PUBLIC HEARING NOTICE IS HEREBY GIVEN that the City Council of the City of Blaine, Minnesota (the “City”), will hold a public hearing on October 7, 2024 beginning at approximately 7:00 P.M. or as soon thereafter as the matter may be heard, at the City Hall, 10801 Town Square Drive NE in the City on the proposal to abate certain property taxes levied by the City on the property listed below (the “Abatement Parcels”); provided, however, that the City may determine at any time to remove certain property from the Abatement Parcels pledged to the payment of the Bonds defined below if it determines that the abatement collected from the remaining Abatement Parcels is sufficient to pay the principal amount of the Bonds. ABATEMENT PARCELS The purpose of the proposed abatement is (i) to assist in financing the acquisition, construction and betterment of an event stadium complex in the City; and (ii) to finance certain public improvements including without limitation acquisition of real property and construction and betterment of certain public infrastructure, which includes but is not limited to public rights-of-way/streets, public utilities, and public open space areas in connection with the development of such event stadium complex (collectively, the “Project”), through the issuance of general obligation tax abatement bonds under Minnesota Statutes, Sections 469.1812 through 469.1815, both inclusive (the “Bonds”). In addition, the EDA proposes entering into an agreement with Blaine Town Center West LLC, a Minnesota limited liability company (or an affiliated entity to be formed, the “Developer”) under which the EDA will provide a portion of the proceeds of the Bonds to the Developer, and the Developer will agree to construct the Project. The assistance will be a “business subsidy” under Minnesota Statues, Sections 116J.993 to 116J.995 (the “Business Subsidy Law”). After the public hearing, if the creation or retention of jobs is determined not to be a goal, the wage and job goals may be set at zero in accordance with the Business Subsidy Law. A summary of the proposed terms of the business subsidy is on file and available for public inspection at the office of the City’s Community Development Director in City Hall during regular business hours. Any person with a residence in the City or who is the owner of taxable property in the City may file a written complaint with the City if the City fails to comply with the Business Subsidy Law. No action may be filed against the City for the failure to comply unless a written complaint is filed. At the public hearing, the City Council will consider an abatement resolution under which the City will pledge all or a portion of the City’s share of property taxes from the Abatement Parcels to the payment of the Bonds. The total amount of abatement is estimated not to exceed $48,500,000, representing the aggregate abatement dollars to be collected by the City over a maximum of 20 years. The proposed abatement bonds will not affect tax rates for the Abatement Parcels or otherwise impact the Abatement Parcels differently from other parcels in the City. The City Council will give all persons who appear at, or submit comments in writing prior to, the hearing an opportunity to express their views with respect to the proposal. BY ORDER OF THE CITY COUNCIL OF THE CITY OF BLAINE, MINNESOTA Published in The Life September 20, 2024 1421953