Details for 2023 TIF Disclosure

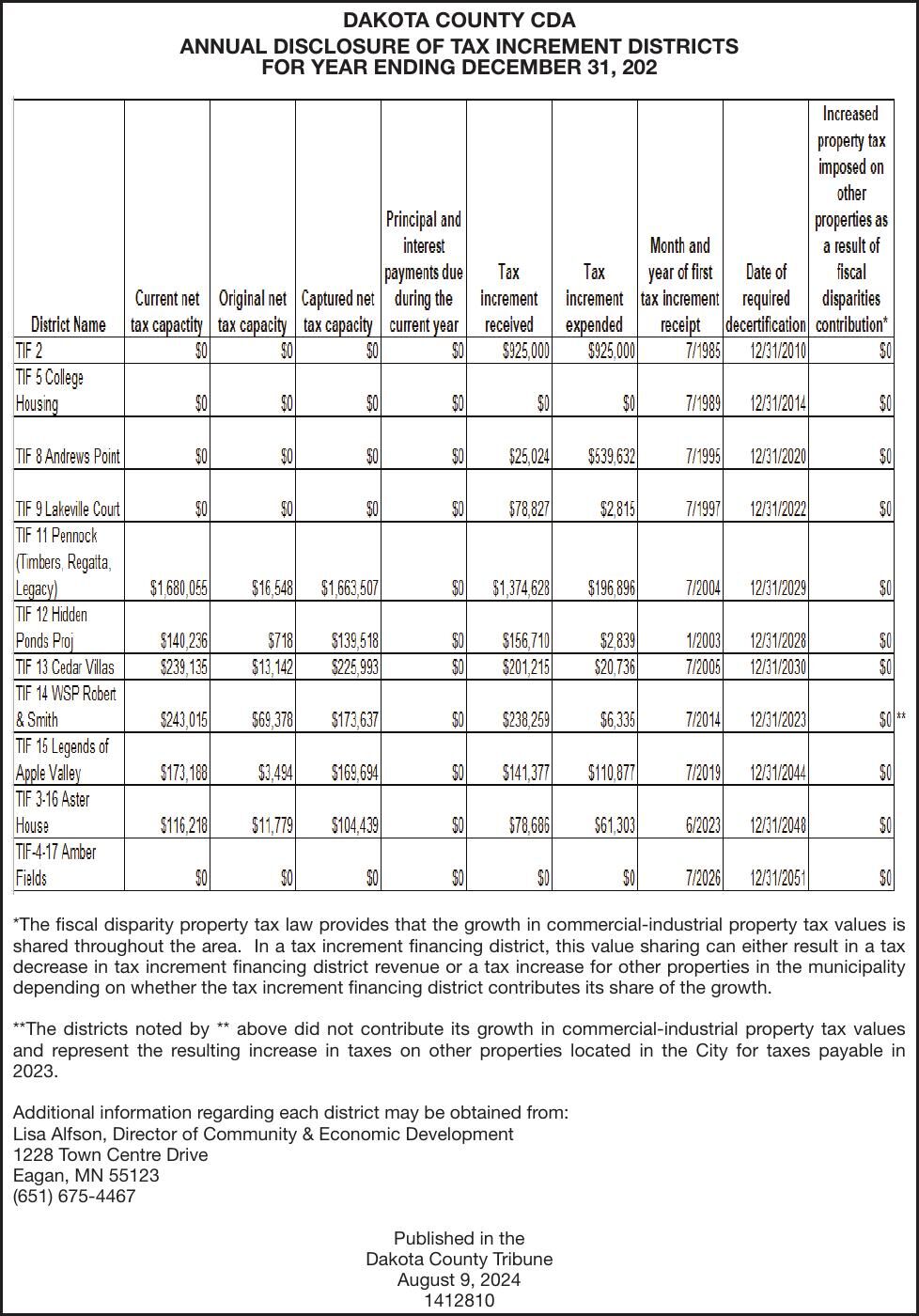

DAKOTA COUNTY CDA ANNUAL DISCLOSURE OF TAX INCREMENT DISTRICTS FOR YEAR ENDING DECEMBER 31, 202 *The fiscal disparity property tax law provides that the growth in commercial-industrial property tax values is shared throughout the area. In a tax increment financing district, this value sharing can either result in a tax decrease in tax increment financing district revenue or a tax increase for other properties in the municipality depending on whether the tax increment financing district contributes its share of the growth. **The districts noted by ** above did not contribute its growth in commercial-industrial property tax values and represent the resulting increase in taxes on other properties located in the City for taxes payable in 2023. Additional information regarding each district may be obtained from: Lisa Alfson, Director of Community & Economic Development 1228 Town Centre Drive Eagan, MN 55123 (651) 675-4467 Published in the Dakota County Tribune August 9, 2024 1412810

DAKOTA COUNTY CDA ANNUAL DISCLOSURE OF TAX INCREMENT DISTRICTS FOR YEAR ENDING DECEMBER 31, 202 *The fiscal disparity property tax law provides that the growth in commercial-industrial property tax values is shared throughout the area. In a tax increment financing district, this value sharing can either result in a tax decrease in tax increment financing district revenue or a tax increase for other properties in the municipality depending on whether the tax increment financing district contributes its share of the growth. **The districts noted by ** above did not contribute its growth in commercial-industrial property tax values and represent the resulting increase in taxes on other properties located in the City for taxes payable in 2023. Additional information regarding each district may be obtained from: Lisa Alfson, Director of Community & Economic Development 1228 Town Centre Drive Eagan, MN 55123 (651) 675-4467 Published in the Dakota County Tribune August 9, 2024 1412810