Details for 2017 Financial Statements

Updated

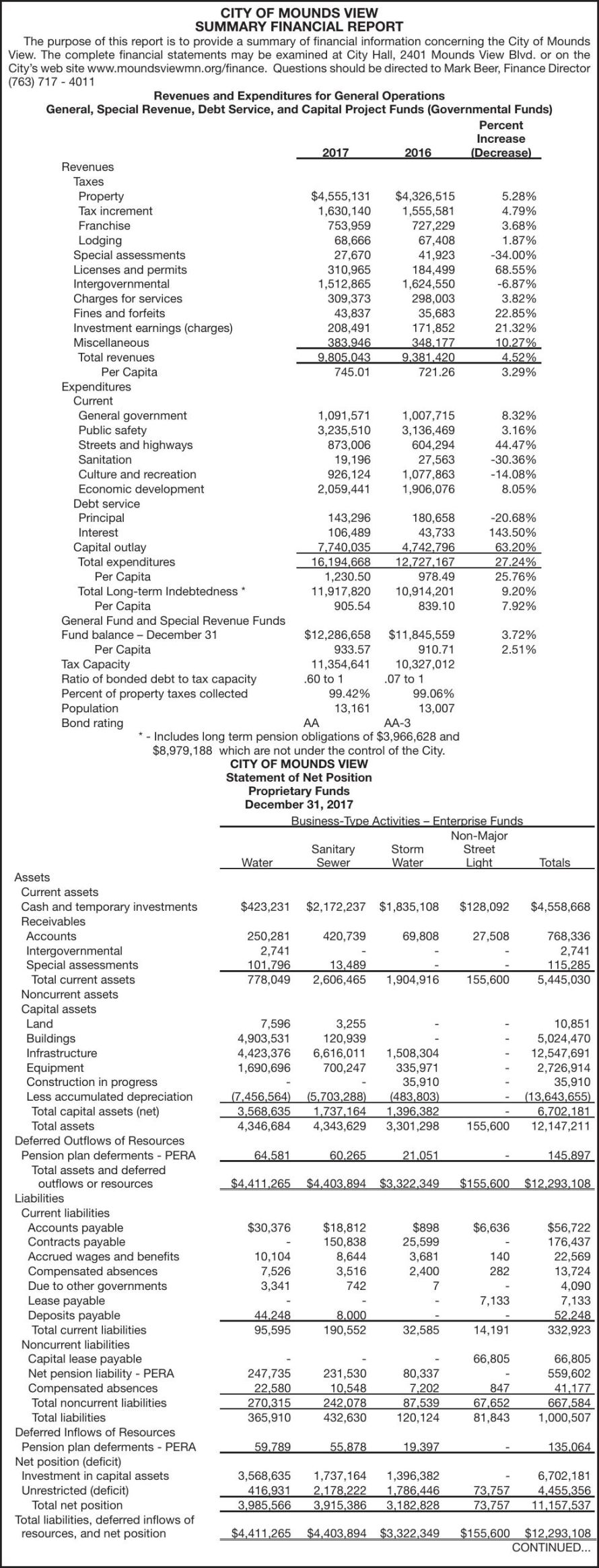

CITY OF MOUNDS VIEW Summary Financial Report The purpose of this report is to provide a summary of financial information concerning the City of Mounds View. The complete financial statements may be examined at City Hall, 2401 Mounds View Blvd. or on the Citys web site www.moundsviewmn.org/finance. Questions should be directed to Mark Beer, Finance Director (763) 717 - 4011 Revenues and Expenditures for General Operations General, Special Revenue, Debt Service, and Capital Project Funds (Governmental Funds) * - Includes long term pension obligations of $3,966,628 and $8,979,188 which are not under the control of the City. CITY OF MOUNDS VIEW Statement of Net Position Proprietary Funds December 31, 2017 CONTINUED...

CITY OF MOUNDS VIEW Summary Financial Report The purpose of this report is to provide a summary of financial information concerning the City of Mounds View. The complete financial statements may be examined at City Hall, 2401 Mounds View Blvd. or on the City’s web site www.moundsviewmn.org/finance. Questions should be directed to Mark Beer, Finance Director (763) 717 - 4011 Revenues and Expenditures for General Operations General, Special Revenue, Debt Service, and Capital Project Funds (Governmental Funds) Percent Increase 2017 2016 (Decrease) Revenues Taxes Property $4,555,131 $4,326,515 5.28% Tax increment 1,630,140 1,555,581 4.79% Franchise 753,959 727,229 3.68% Lodging 68,666 67,408 1.87% Special assessments 27,670 41,923 -34.00% Licenses and permits 310,965 184,499 68.55% Intergovernmental 1,512,865 1,624,550 -6.87% Charges for services 309,373 298,003 3.82% Fines and forfeits 43,837 35,683 22.85% Investment earnings (charges) 208,491 171,852 21.32% Miscellaneous 383,946 348,177 10.27% Total revenues 9,805,043 9,381,420 4.52% Per Capita 745.01 721.26 3.29% Expenditures Current General government 1,091,571 1,007,715 8.32% Public safety 3,235,510 3,136,469 3.16% Streets and highways 873,006 604,294 44.47% Sanitation 19,196 27,563 -30.36% Culture and recreation 926,124 1,077,863 -14.08% Economic development 2,059,441 1,906,076 8.05% Debt service Principal 143,296 180,658 -20.68% Interest 106,489 43,733 143.50% Capital outlay 7,740,035 4,742,796 63.20% Total expenditures 16,194,668 12,727,167 27.24% Per Capita 1,230.50 978.49 25.76% Total Long-term Indebtedness * 11,917,820 10,914,201 9.20% Per Capita 905.54 839.10 7.92% General Fund and Special Revenue Funds Fund balance – December 31 $12,286,658 $11,845,559 3.72% Per Capita 933.57 910.71 2.51% Tax Capacity 11,354,641 10,327,012 Ratio of bonded debt to tax capacity .60 to 1 .07 to 1 Percent of property taxes collected 99.42% 99.06% Population 13,161 13,007 Bond rating AA AA-3 * - Includes long term pension obligations of $3,966,628 and $8,979,188 which are not under the control of the City. CITY OF MOUNDS VIEW Statement of Net Position Proprietary Funds December 31, 2017 Business-Type Activities – Enterprise Funds Non-Major Sanitary Storm Street Water Sewer Water Light Totals Assets Current assets Cash and temporary investments $423,231 $2,172,237 $1,835,108 $128,092 $4,558,668 Receivables Accounts 250,281 420,739 69,808 27,508 768,336 Intergovernmental 2,741 2,741 Special assessments 101,796 13,489 115,285 Total current assets 778,049 2,606,465 1,904,916 155,600 5,445,030 Noncurrent assets Capital assets Land 7,596 3,255 10,851 Buildings 4,903,531 120,939 5,024,470 Infrastructure 4,423,376 6,616,011 1,508,304 12,547,691 Equipment 1,690,696 700,247 335,971 2,726,914 Construction in progress 35,910 35,910 Less accumulated depreciation (7,456,564) (5,703,288) (483,803) - (13,643,655) Total capital assets (net) 3,568,635 1,737,164 1,396,382 6,702,181 Total assets 4,346,684 4,343,629 3,301,298 155,600 12,147,211 Deferred Outflows of Resources Pension plan deferments - PERA 64,581 60,265 21,051 145,897 Total assets and deferred outflows or resources $4,411,265 $4,403,894 $3,322,349 $155,600 $12,293,108 Liabilities Current liabilities Accounts payable $30,376 $18,812 $898 $6,636 $56,722 Contracts payable 150,838 25,599 176,437 Accrued wages and benefits 10,104 8,644 3,681 140 22,569 Compensated absences 7,526 3,516 2,400 282 13,724 Due to other governments 3,341 742 7 4,090 Lease payable 7,133 7,133 Deposits payable 44,248 8,000 52,248 Total current liabilities 95,595 190,552 32,585 14,191 332,923 Noncurrent liabilities Capital lease payable 66,805 66,805 Net pension liability - PERA 247,735 231,530 80,337 559,602 Compensated absences 22,580 10,548 7,202 847 41,177 Total noncurrent liabilities 270,315 242,078 87,539 67,652 667,584 Total liabilities 365,910 432,630 120,124 81,843 1,000,507 Deferred Inflows of Resources Pension plan deferments - PERA 59,789 55,878 19,397 135,064 Net position (deficit) Investment in capital assets 3,568,635 1,737,164 1,396,382 6,702,181 Unrestricted (deficit) 416,931 2,178,222 1,786,446 73,757 4,455,356 Total net position 3,985,566 3,915,386 3,182,828 73,757 11,157,537 Total liabilities, deferred inflows of resources, and net position $4,411,265 $4,403,894 $3,322,349 $155,600 $12,293,108 CONTINUED...