Details for 2017 Summary TIF Information

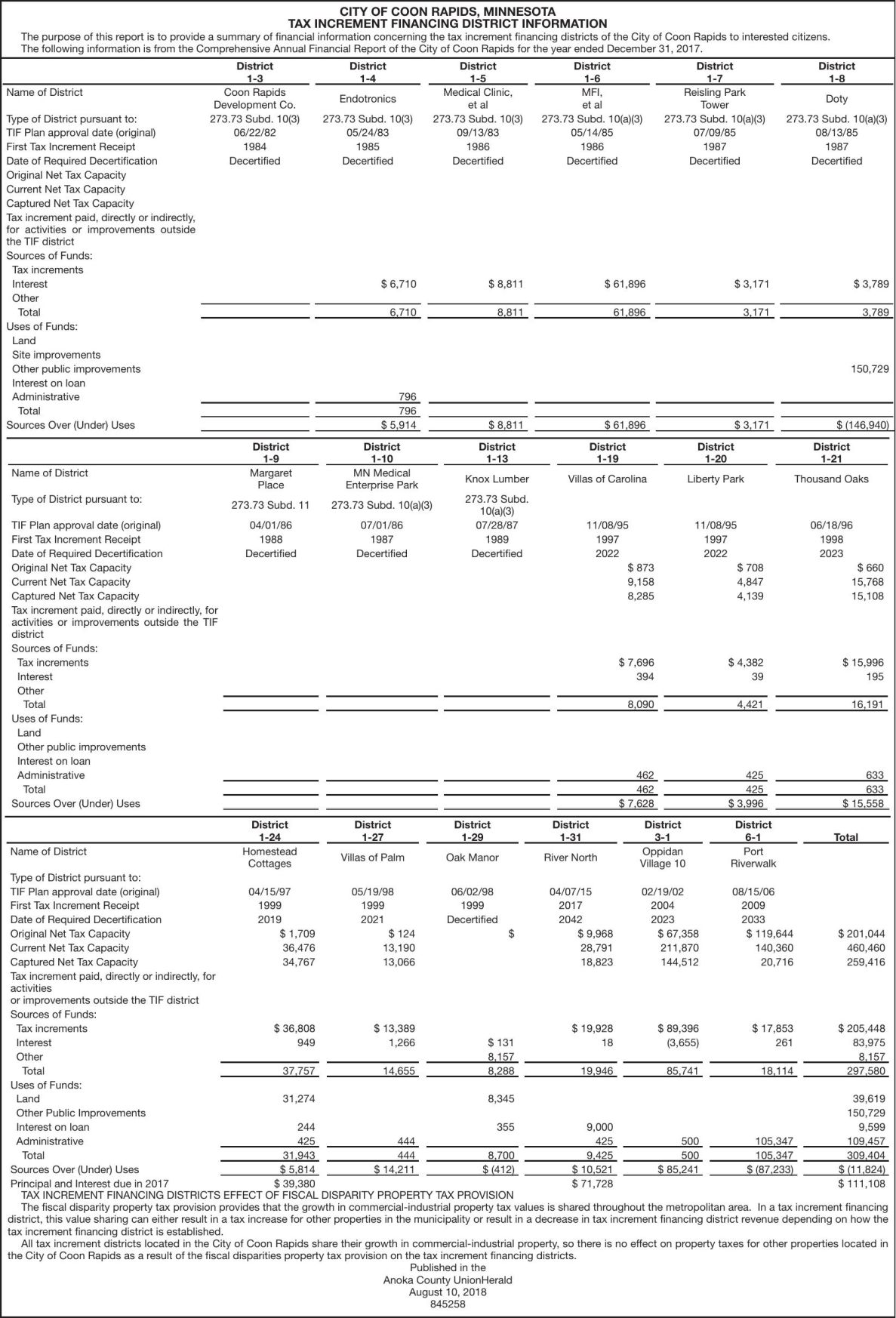

City of Coon Rapids, Minnesota TAX INCREMENT FINANCING DISTRICT INFORMATION The purpose of this report is to provide a summary of financial information concerning the tax increment financing districts of the City of Coon Rapids to interested citizens. The following information is from the Comprehensive Annual Financial Report of the City of Coon Rapids for the year ended December 31, 2017. TAX INCREMENT FINANCING DISTRICTS EFFECT OF FISCAL DISPARITY PROPERTY TAX PROVISION The fiscal disparity property tax provision provides that the growth in commercial-industrial property tax values is shared throughout the metropolitan area. In a tax increment financing district, this value sharing can either result in a tax increase for other properties in the municipality or result in a decrease in tax increment financing district revenue depending on how the tax increment financing district is established. All tax increment districts located in the City of Coon Rapids share their growth in commercial-industrial property, so there is no effect on property taxes for other properties located in the City of Coon Rapids as a result of the fiscal disparities property tax provision on the tax increment financing districts. Published in the Anoka County UnionHerald August 10, 2018 845258

City of Coon Rapids, Minnesota TAX INCREMENT FINANCING DISTRICT INFORMATION The purpose of this report is to provide a summary of financial information concerning the tax increment financing districts of the City of Coon Rapids to interested citizens. The following information is from the Comprehensive Annual Financial Report of the City of Coon Rapids for the year ended December 31, 2017. Name of District Type of District pursuant to: TIF Plan approval date (original) First Tax Increment Receipt Date of Required Decertification Original Net Tax Capacity Current Net Tax Capacity Captured Net Tax Capacity Tax increment paid, directly or indirectly, for activities or improvements outside the TIF district Sources of Funds: Tax increments Interest Other Total Uses of Funds: Land Site improvements Other public improvements Interest on loan Administrative Total Sources Over (Under) Uses District 1-3 Coon Rapids Development Co. 273.73 Subd. 10(3) 06/22/82 1984 Decertified Name of District Type of District pursuant to: TIF Plan approval date (original) First Tax Increment Receipt Date of Required Decertification Original Net Tax Capacity Current Net Tax Capacity Captured Net Tax Capacity Tax increment paid, directly or indirectly, for activities or improvements outside the TIF district Sources of Funds: Tax increments Interest Other Total Uses of Funds: Land Other public improvements Interest on loan Administrative Total Sources Over (Under) Uses Name of District District 1-4 District 1-5 Medical Clinic, et al 273.73 Subd. 10(3) 09/13/83 1986 Decertified District 1-6 MFI, et al 273.73 Subd. 10(a)(3) 05/14/85 1986 Decertified $ 6,710 $ 8,811 $ 61,896 $ 3,171 $ 3,789 6,710 8,811 61,896 3,171 3,789 Endotronics 273.73 Subd. 10(3) 05/24/83 1985 Decertified District 1-7 Reisling Park Tower 273.73 Subd. 10(a)(3) 07/09/85 1987 Decertified District 1-8 Doty 273.73 Subd. 10(a)(3) 08/13/85 1987 Decertified 150,729 796 796 $ 5,914 District 1-9 Margaret Place District 1-10 MN Medical Enterprise Park 273.73 Subd. 11 273.73 Subd. 10(a)(3) 04/01/86 1988 Decertified 07/01/86 1987 Decertified District 1-24 Homestead Cottages $ 8,811 $ 61,896 $ 3,171 $ (146,940) District 1-13 District 1-19 District 1-20 District 1-21 Knox Lumber Villas of Carolina Liberty Park Thousand Oaks 11/08/95 1997 2022 06/18/96 1998 2023 273.73 Subd. 10(a)(3) 07/28/87 1989 Decertified 11/08/95 1997 2022 $ 873 9,158 8,285 District 1-27 District 1-29 District 1-31 Villas of Palm Oak Manor River North $ 708 4,847 4,139 $ 660 15,768 15,108 $ 7,696 394 $ 4,382 39 $ 15,996 195 8,090 4,421 16,191 462 462 $ 7,628 425 425 $ 3,996 633 633 $ 15,558 District 3-1 Oppidan Village 10 District 6-1 Port Riverwalk Total Type of District pursuant to: TIF Plan approval date (original) 04/15/97 05/19/98 06/02/98 04/07/15 02/19/02 08/15/06 First Tax Increment Receipt 1999 1999 1999 2017 2004 2009 Date of Required Decertification 2019 2021 Decertified 2042 2023 2033 Original Net Tax Capacity $ 1,709 $ 124 $ $ 9,968 $ 67,358 $ 119,644 $ 201,044 Current Net Tax Capacity 36,476 13,190 28,791 211,870 140,360 460,460 Captured Net Tax Capacity 34,767 13,066 18,823 144,512 20,716 259,416 Tax increment paid, directly or indirectly, for activities or improvements outside the TIF district Sources of Funds: Tax increments $ 36,808 $ 13,389 $ 19,928 $ 89,396 $ 17,853 $ 205,448 Interest 949 1,266 $ 131 18 (3,655) 261 83,975 Other 8,157 8,157 Total 37,757 14,655 8,288 19,946 85,741 18,114 297,580 Uses of Funds: Land 31,274 8,345 39,619 Other Public Improvements 150,729 Interest on loan 244 355 9,000 9,599 Administrative 425 444 425 500 105,347 109,457 Total 31,943 444 8,700 9,425 500 105,347 309,404 Sources Over (Under) Uses $ 5,814 $ 14,211 $ (412) $ 10,521 $ 85,241 $ (87,233) $ (11,824) Principal and Interest due in 2017 $ 39,380 $ 71,728 $ 111,108 TAX INCREMENT FINANCING DISTRICTS EFFECT OF FISCAL DISPARITY PROPERTY TAX PROVISION The fiscal disparity property tax provision provides that the growth in commercial-industrial property tax values is shared throughout the metropolitan area. In a tax increment financing district, this value sharing can either result in a tax increase for other properties in the municipality or result in a decrease in tax increment financing district revenue depending on how the tax increment financing district is established. All tax increment districts located in the City of Coon Rapids share their growth in commercial-industrial property, so there is no effect on property taxes for other properties located in the City of Coon Rapids as a result of the fiscal disparities property tax provision on the tax increment financing districts. Published in the Anoka County UnionHerald August 10, 2018 845258